Investors buy and sell homes regularly, so they’ve come to understand the nuances and most effective strategies to score amazing real estate deals. In the same way a classic car enthusiast has a garage full of Porsche 356s and Austin-Healeys, investors have a wealth of knowledge that’s just waiting to be tapped into. Best of all, the strategies investors use are easy to apply and don’t cost any money to implement.

What you’ll learn:

How does saving thousands of dollars sound? What about saving hundreds of thousands in 10 years? Few things are more exciting, and this article will teach you to do just that with the 6 brilliant strategies investors use to buy their own home.

1. Investors provide multiple offers

Most buyers typically provide just one option which causes the seller to, as is human nature, focus on the highest offer. What happens if you give sellers multiple offers? Phil Anderson, an investor at Good Vibes Homebuyers says, “it not only makes you stand out, but it also helps people see that the terms of each offer can be more lucrative than the offer price itself.” Let’s say a house would sell for $200,000 and the investor provides three offers: bank financing for $195k, seller financing for $250k with $100k down and $1k monthly payments for 3 years, and $220,000 to assume the existing mortgage. The bank finance offer is common, however the other two are good options for sellers who want monthly payments (seller financing) or they don’t have enough equity to sell for a profit (mortgage assumption).

2. Investors get all the financing they can

If you put down less than 20%, lenders require you to pay Private Mortgage Insurance (PMI). The thought of paying PMI is dreadful to many homeowners so they give up their cash to avoid it. Contrarily, investors gladly pay PMI, often financing up to the maximum allowed. The reason investors do this is twofold:

First, in most markets’ home values are rapidly increasing while you’re paying down principal every month. This means that homeowners often achieve 20% equity (80% loan-to-value ratio) many years ahead of schedule and can remove PMI.

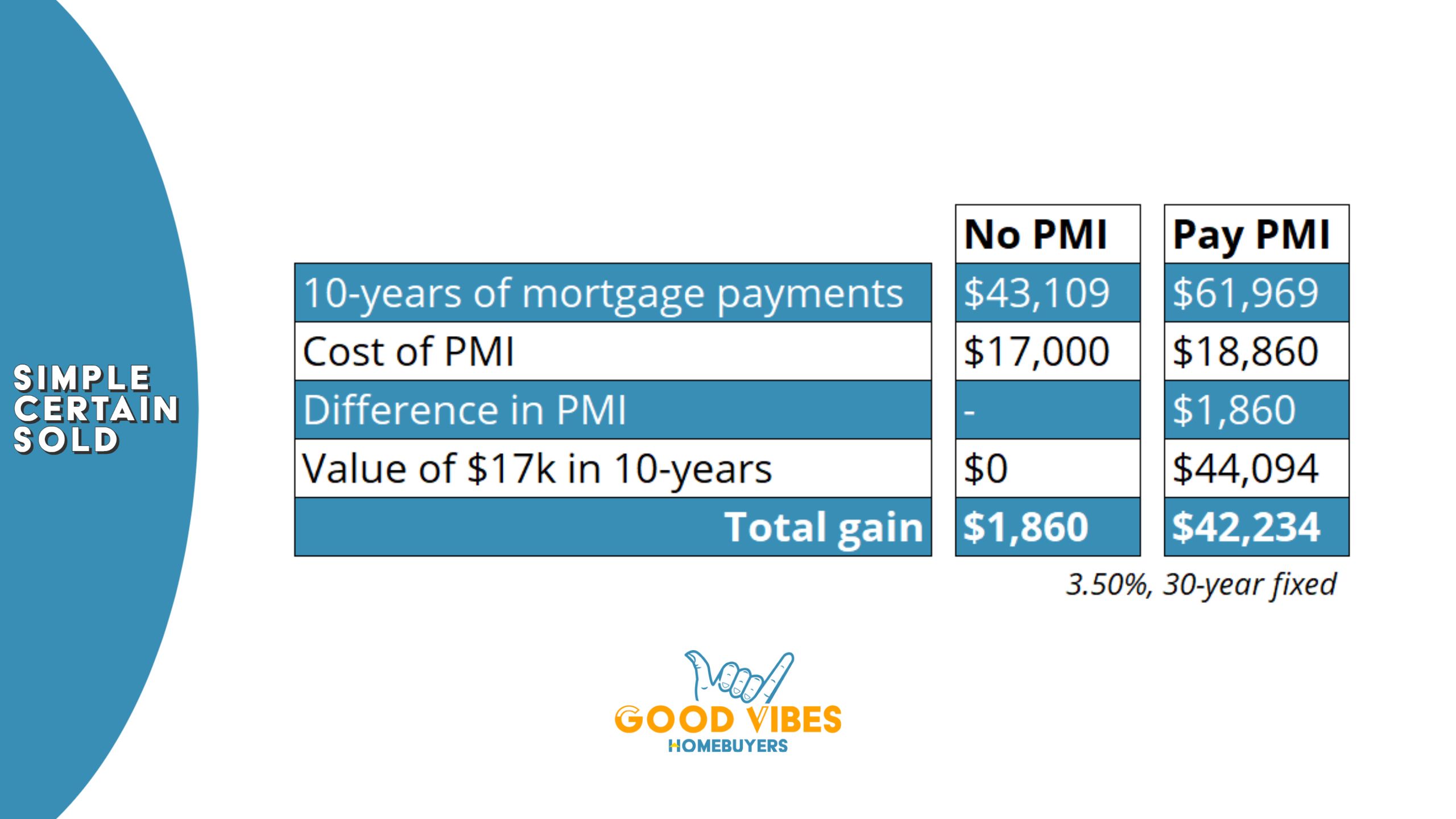

Second, cash is king, and investors know they can use their cash to acquire more income producing assets. For non-investors, it’s critical that you take the cash you would have otherwise spent on a 20% down payment and use it to grow your money. For example, you buy a $100k house and put down 3%. You invest the remaining $17k in a mutual fund which tracks the S&P 500 index (10% average growth since 1920). Here’s how you’d fare in 10 years:

You had to invest $17k to save $1,860 over the course of 10 years. But the biggest difference would be missing on the increase in your S&P 500 investment. In 10 years, it’s worth $42k more than the no PMI option. The monthly mortgage payment is not drastically different either: $515 at 3% down or $360 at 20% down. This totals $18,600 in extra payments over 10 years, subtract this from your total gain and you’re still well ahead.

You had to invest $17k to save $1,860 over the course of 10 years. But the biggest difference would be missing on the increase in your S&P 500 investment. In 10 years, it’s worth $42k more than the no PMI option.

3. Investors pay a higher price if given closing costs credits

This is all about keeping your cash close so that you can make it work for you. If a seller wants $250k and the home is worth $245k, so be it, agree to $250k provided your seller offers a $3-5k closing credit. Sure, it decreases your equity, but it also decreases the amount of cash you need to bring to the closing table. This strategy investors use to buy their own home creates it a win-win deal.

4. Investors target off market properties

Although you can find quality investments on the MLS, the best deals are rarely listed. According to the National Association of Realtors, a total of 5.64 million homes were sold in 2020 with 733,200 sold off-market. This means there are plenty of opportunities (to be exact, 1.3 out of every 10) to find your dream home. We recommend driving through your desired neighborhood and jotting down the address of homes you like. Then, use a postcard printing service or write handwritten letters to those homeowners saying that you’re interested in buying their home for yourself. This eliminates competition, can cutout fees like realtor commissions, and it allows you to negotiate directly with the seller

5. Investors follow up often and directly with the seller

This shouldn’t be associated with brilliant strategies investors use to buy their own home; however, most people get 90% to their goal and stop. It is therefore the ones who go the extra 10% who truly are brilliant because, on average, investors must send 100 postcards to get 1 phone call and they must get 10 phone calls to close 1 deal. It’s a lot of work but the 10-percenters don’t let those 10 phone calls go to waste because they know deals rarely close on the initial call. This means investors nurture each lead by regularly following up via email, phone, and text.

6. Investors always have an escape plan

One of the brilliant strategies investors use to buy their own home is knowing what they’ll do if things go south. This is the essence of – hope for the best but plan for the worst by knowing your numbers. When buying his own home in New Braunfels, Will Rugeley, an investor at Good Vibes Homebuyers said he followed these principles:

a. Don’t buy more home than you can afford

b. Run the numbers to see how many years before PMI can be dropped

c. Run the numbers to see how many years until you can refinance

d. Know how much your home can rent for during your first year of ownership

e. Don’t buy homes that fail to break even when rented during your first year of ownership.

7. Investors keep up to date on local real estate prices to gauge appreciation in their neighborhood. Once an 80% loan-to-value ratio is achieved, they cancel PMI (often years ahead of the bank’s projection).

8. Investors gladly pay to have their home inspected by experts before they close. The things you rarely notice are often the most expensive to repair so have (for instance) a foundation expert look for any issues and a plumber run a camera through the sewer lines.

9. If competing with other buyers, to stand out provide a larger option fee or make a bigger earnest money deposit. Option fees are non-refundable and range from $10-$100, earnest money deposits typically are refundable and range from 0.5-1%.

1. Which strategy does Good Vibes Homebuyers find to be the most effective?

a. In terms of closing your deal, following up regularly and directly with your seller is critical. When it comes to your future success, it’s paramount that you finance as much as possible.

2. Can you help me figure out what kind of offers I should make?

a. As our name reveals, we’re all about putting Good Vibes into the world so if you need help with creating offers, running numbers, or devising an exit strategy, and even if you’re not selling to us, we’re glad to help for free. Shoot us an Instagram message.

3. How can I find out how much my home will rent for?

a. We use RentRange and have found it to be very accurate. It costs about $10 per report.

4. What should my home rent for to break even?

a. A good rule of thumb is your monthly principal and interest payment should not exceed 50% of your monthly rent rate.

Get free advice with a personal touch from local experts in central Texas. Good Vibes Homebuyers will gladly offer other brilliant strategies investors use to buy their own home to make your home purchase a success! Contact us today for a free home valuation report or to ask any questions about buying and selling. It’s time for you to thrive with Good Vibes Homebuyers!

Free closing costs. Free Local Move. Zero fees. Sell in 5 days. Sell and stay for 180 days. No equity? Still get $10,000 cash!

Picking the wrong investor can leave you scrambling & empty-handed. Learn how to spot the bad from good investors & see the top reasons to pick Good Vibes Homebuyers.

What sounds better - winning or losing? Home investors don't want you to know these 4 magic negotiation tactics because you'll kick their butt and come out a winner!

Good Vibes Homebuyers might be the perfect option for many Texas property owners needing to sell a house. Ask yourself these questions to see if our investors are right for you.