What would you say if you got $2 back for every $1 invested? What would you do if you had enough money to complete the kitchen updates you swore you’d make before buying your home? If you don’t make these 9 dumb home buying mistakes, you’ll set yourself up to achieve all that and more.

What you’ll learn:

Whether you’re a low- or high-income earner, buying a home may be the single biggest financial decision you ever make. If made properly, it should elevate you financially but if you make even 1 of these 9 dumb home buying mistakes, it can cost you tens or even hundreds of thousands of dollars, or worse, saddle you with a home you can’t afford or sell.

1. Not financing enough

This dumb home buying mistake people make is contrary to almost anything else you’ll hear. It requires strategy, but if executed properly, it can make your money grow astronomically: do not put down more than 5% of your home’s purchase price. You may be saying “if I put down less than 20%, I’ll have to pay private mortgage insurance” (PMI). So be it. Cash is king, and you can use it to buy income producing assets. For example, you instead put down 5% and invest the remaining 15%. Your home cost $150k so you put down $7,500 (5%). You invest the remaining $22,500 (15%) in a mutual fund which tracks the S&P 500 index (since 1920, average 10% growth). Here’s how much more you’d have in just 10 years:

2. Not trading closing cost credits for a higher sale price

Have you ever heard that you shouldn’t work for money, money should instead work for you? If a seller wants $250k and you think the home is worth only $245k, so what, pay $250k if the seller provides a $3-5k closing credit. This can be a win-win-win because the seller gets the highest possible sale price, and the buyer gets the home they want plus they reduce the amount of cash they must bring to the closing table. What then can you do with the money you didn’t need? Make it work for you by investing in income producing assets.

If a seller wants $250k and the home is worth only $245k, so what, pay $250k if the seller gives you a $3-5k closing credit. This can be a win-win-win.

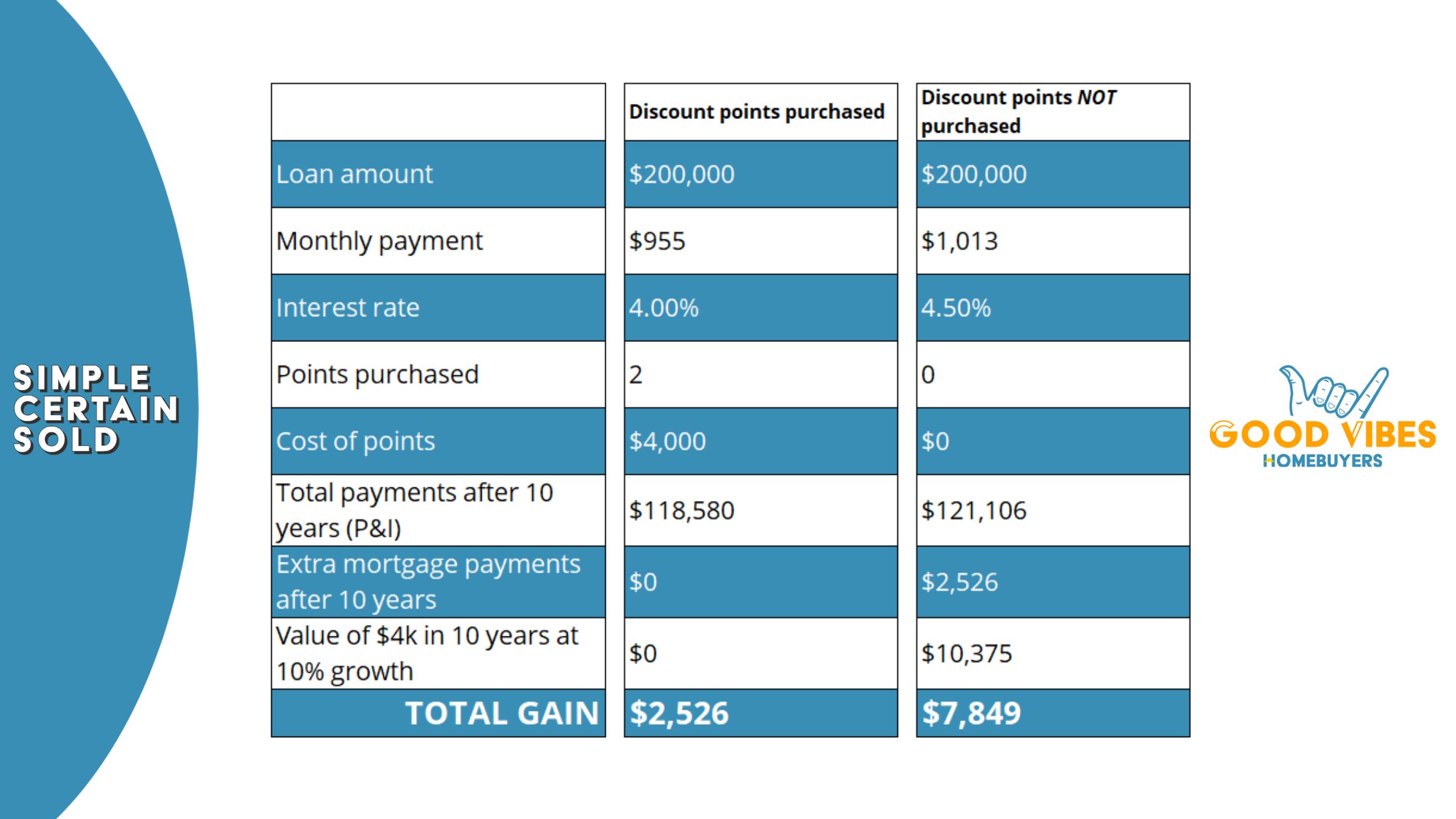

3. Buying discount points

Discount points reduce the interest rate of your mortgage. Each point typically lowers the interest rate 0.25% and costs 1% of the mortgage amount. So, buying two points off a 4.5% interest rate on a $200k mortgage would lower the interest rate to 4.00% and cost $4,000. If you don’t stay in your home long enough to break even, buying points is a dumb home buying mistake. Worse, giving up more cash than necessary restricts your ability to make your money work for you. Here’s a comparison of why you shouldn’t make this dumb home buying mistake:

4. Not shopping lenders

You cannot afford to make this dumb home buying mistake as it’s completely free and takes very little effort. We recommend you contact and complete a mortgage application with at least three banks. Don’t be bashful either, during your first conversation be sure to tell each lender that you’re interested in seeing what rate and terms they can offer but that you’re in no rush and will choose the best deal. In a polite, professional way, this puts lenders on notice that you have options, and they therefore know they must bring their best to earn your business.

After you receive each lenders proposal, call those who are the least competitive to tell them that another lender offered better solutions. Many lenders at this point will improve their rate and terms to win your business. Even if it’s reducing your interest rate just 0.05%, it would save you more than $2k in interest payments on a $200k mortgage.

5. Buying too much home

Just because you’re preapproved for a $400k mortgage doesn’t mean you can afford a $400k home. To figure out what you can afford we recommend you conduct a thorough analysis of your financial situation, however, a quick good rule of thumb is that your monthly mortgage payment should be no more than 33% of your monthly take home pay.

Don’t become disillusioned into thinking that you can stretch your payment because your earnings should increase over time. As the 2008 market crash and coronavirus pandemic have proven, income can wildly fluctuate, and jobs are far from guaranteed.

6. Only getting a mortgage prequalification letter

Mortgage prequalification is very different from mortgage preapproval. The preapproval process is more thorough with lenders carefully examining and verifying your financial situation, including running a hard credit report. The result is that lenders can guarantee your mortgage up to a certain amount at a certain interest rate. Getting prequalified differs in two notable ways: (1) Your financial information is simply reviewed; not verified and scrutinized. (2) Instead of a mortgage guarantee, you only receive a decision on mortgage eligibility within a range of interest rates and a loan amount you may be approved for.

To avoid this dumb home buying mistake, inform lenders that you’re seeking a preapproval letter – not a prequalification letter.

7. Quitting your day job during escrow

Just because your closing day is scheduled and all paperwork is approved, don’t make the dumb home buying mistake of thinking your mortgage is a done deal. Lenders will verify employment and salary before funding your mortgage. When buying his home in 2021 Good Vibes Homebuyers investor Will Rugeley says that his lender called his employer while he was at the title company signing closing documents. Don’t quit your day job until your home loan has funded. Similarly, don’t apply for any credit cards or take out any loans until the deal has closed and you own your new home. A day or two before closing lenders will do a soft pull on your credit to ensure there haven’t been any major changes.

8. Skipping a home inspection

Unless you’re a real estate investor, before you buy you need to have your home inspected. The things you rarely notice are often the most expensive to repair so we recommend you have a foundation expert look for any structural issues, a plumber run a camera through the sewer lines to uncover any breaks, and a licensed home inspector prepare an inspection report. The cost of each inspection can range from $200 to $600 but the benefits should far outweigh the cost. If your inspection uncovers costly issues, you have leverage to negotiate a lower price, have the seller complete the repairs, or to receive closing cost credits. At minimum, you have peace of mind knowing that you likely won’t experience costly issues during your first several years of ownership.

9. Not being special with your offer

The real estate market has been on fire and there’s few signs of it piping down. Every home you make an offer on will already probably have 3 offers and 3 more will probably follow behind yours. This means you must be special and doing that doesn’t mean you must make the highest offer, but it does mean you must stand out from the crowd. Here are some ideas: send a handwritten note saying why you love the seller’s home, provide a larger non-refundable option fee, make a bigger earnest money deposit, remove contract contingencies, or even invite the seller to a lunch on you (most will decline but the gesture goes a long way). The bottom line is – avoiding this dumb home buying mistake can be free, takes very little effort, and it can make all the difference.

1. What’s another dumb home buying mistake you’ve seen people make?

a. Buying the most expensive house in a neighborhood. The value of a home is based off similar homes in the same or nearby neighborhood. If your home is unlike any other, it’ll sell for less because there’s nothing to establish its value

2. If Good Vibes Homebuyers had to choose just one tip to implement, which would it be?

a. Not financing enough.

3. How can I ensure I don’t make any of these dumb home buying mistakes?

a. It can be easy to fall in love with a home. But the key to success is not letting your emotions take over. Run through your finances, shop lenders, get preapproved – have a plan and stick to it.

As homebuyers, we’ve seen many people make many dumb home buying mistakes and we’re willing to share those mistakes with you for free. In so doing, our hope is that you achieve your home buying and home selling goals. Contact us today and we’ll help you save thousands.

Free closing costs. Free Local Move. Zero fees. Sell in 5 days. Sell and stay for 180 days. No equity? Still get $10,000 cash!

Picking the wrong investor can leave you scrambling & empty-handed. Learn how to spot the bad from good investors & see the top reasons to pick Good Vibes Homebuyers.

What sounds better - winning or losing? Home investors don't want you to know these 4 magic negotiation tactics because you'll kick their butt and come out a winner!

Good Vibes Homebuyers might be the perfect option for many Texas property owners needing to sell a house. Ask yourself these questions to see if our investors are right for you.