Some people believe that buying their dream home is an unattainable pipedream. But, as Henry Ford said, “whether you think you can or think you can’t, you’re right.” The fact is, even someone with a modest salary can buy their dream home. The key to doing so is educating yourself on various buying strategies and devising a plan to execute on them.

What you’ll learn

As owners of more than 20 rental properties and after completing 5-10 fix-and-flips a year, we’ve learned many tricks that can be leveraged by anyone. After reading this, you’ll understand these tools and have a solid plan for how you can buy more home for less money.

1. Know how to spot a motivated seller

Three categories of home sellers exist: those who want to sell, those who need to sell, and those who can’t live without selling. The latter are known as motivated sellers and is the category where you’ll find your best deals (though, buying more home for less money can be found with the second category too). When searching for motivated sellers look for these situations and circumstances:

a. Homes in pre-foreclosure or foreclosure

b. Homes that are delinquent on property taxes

c. Homes that appear vacant

d. Recently inherited homes

e. Homes owned by recent divorcees

f. Rented homes where the tenant is a problem

g. Homes in poor condition and homes that aren’t good candidates for listing on the MLS

h. Investor-owned homes where the investor wants to retire or sell to acquire another property

Here’s how you can find motivated sellers:

a. Direct mail marketing

b. Purchasing lists of motivated sellers from sources like listsource

c. County foreclosure auction

d. Driving your neighborhood looking for vacant homes

e. Attending estate sales

f. Responding to ‘For Sale by Owner’ signs

Finding motivated sellers is not easy, but it’s one of the great strategies you can use to buy more home for less money.

2. Use the tax code to your advantage

Even if you don’t own a home today, this strategy can pay massive dividends in as little as 2 years. One of the great parts about owning and occupying a home is that when you sell you do not have to pay capital gains tax. Let’s say you purchased your home for $160,000 and have lived in it for 2 years (or, if you buy a home tomorrow, this scenario could apply to you in just 2 years). Since your purchase you’ve paid down the mortgage to $151,000, made about $5,000 in value-add improvements, and, most notably, your home has appreciated to $220,000. You decide to sell, here’s how you’d fare:

The tax-free gain can then be used to buy more home for less money. You may be saying “but that’s not less money” and practically speaking, you’d be right. However, think of it this way – how many days did you have to show up for work to earn $49,000? Zero, you in fact didn’t earn it, you instead made it because of a smart investment. It’s free money and therefore spending it to buy more home feels like less money.

You may be saying “but that’s not less money” and practically speaking, you’d be right. However, think of it this way – how many days did you have to show up for work to earn $49,000? Zero, you in fact didn’t earn it, you instead made it because of a smart investment.

3. Finance the hell out of your home

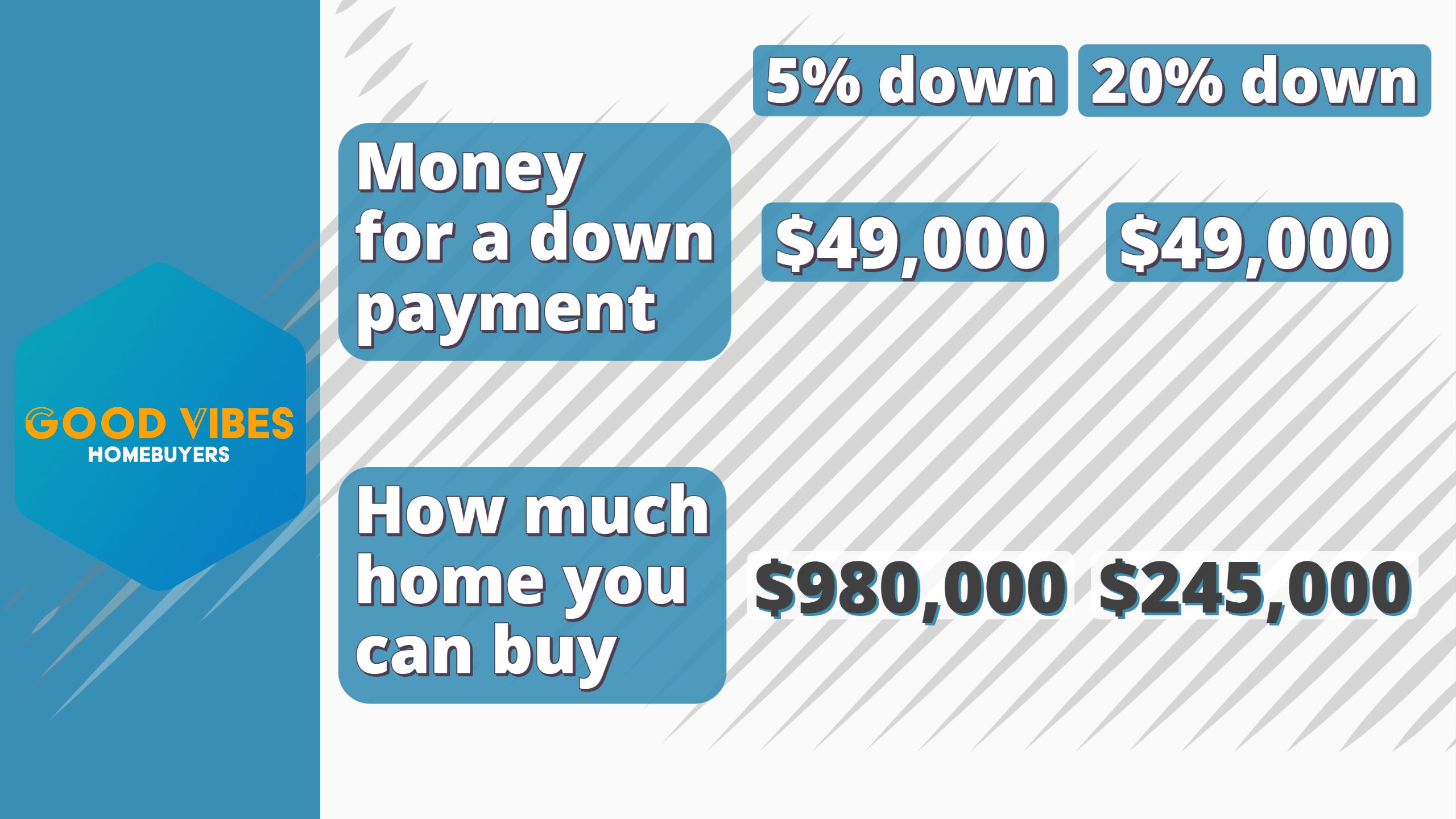

Cash is king and this strategy is all about keeping yours. Some loans allow you to put down as little as 3% (no down payment is required for VA loans). Because you’re putting down so little, it allows you to buy more home for less money. For example, if you have $49,000 (as in the real-life scenario above), let’s compare how much more home you can buy when putting down just 5% instead of the commonly suggested 20%:

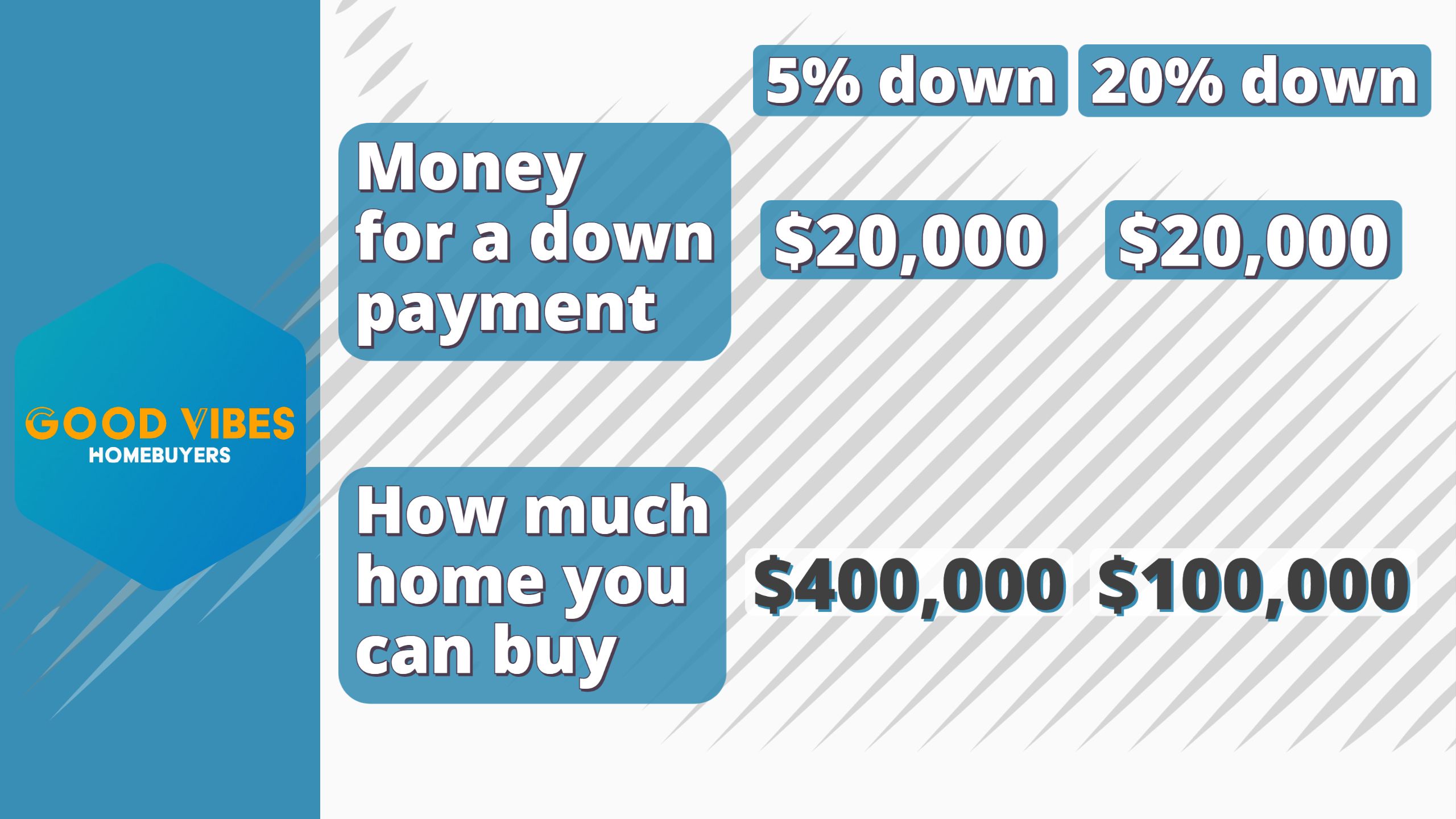

But you’re smart – you know not to use all your cash since you’re putting down less and want to maintain a cash cushion to offset the higher monthly payment. You decide to instead put down $20,000. Here’s how much more home you could buy for less money:

4. How to make it a win-win-win for the seller to finance a portion of the sale

Even though putting down less money allows you to buy more home, some home buyers may not qualify for a $400,000 mortgage. Here’s your solution: ask the seller to carry (meaning finance) a portion of the sale price. You can then apply for a smaller bank mortgage (which results in an even smaller down payment) and have the seller finance the difference between your mortgage and the sale price. This strategy to buy more home for less money can be a win-win-win because the seller gets their desired sale price, you get your dream home, and (presumably) you get favorable terms on the second mortgage you negotiated with the seller.

Favorable terms for the seller could include lower taxes on the sale and regular monthly income, and, for the buyer, could include a no interest loan and/or low monthly payments with a balloon payment. How is this beneficial? A no interest loan (meaning the buyer pays principal only) allows the sale price to increase up to 20%, it reduces the seller’s tax burden by spreading gains over multiple years, and monthly payments with a balloon payment allows the seller to get paid three times – a large lump sum from your bank financing, monthly payments, and another large lump sum at the end of the negotiated seller finance term.

5. Leverage the real estate pricing pyramid

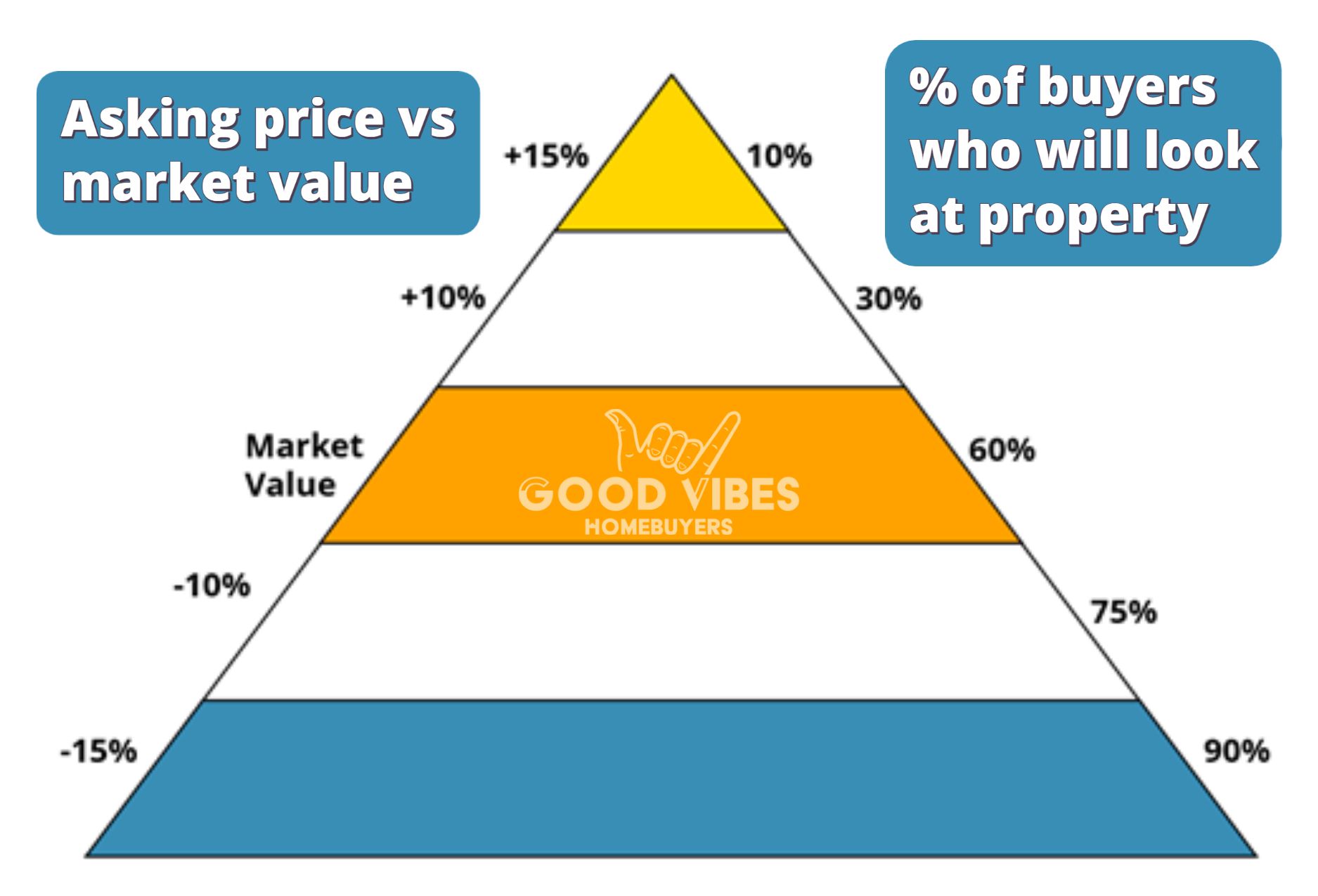

Now that you know how you can buy more home for less money, there’s one more strategy to add to your arsenal: you must weed out the competition. To do this, incorporate the long-held real estate pricing pyramid which considers the relationship between a home’s asking price and the percentage of buyers who will be interested in making offers on a home.

To leverage the pricing pyramid effectively, you must not be scared away by high asking prices or homes that have been on the market for extended periods. These two factors are exactly why you’ll be able to buy more home for less money. What happens when there’s less competition? It drives prices down as sellers start to seek a way out. In short, sellers transition from want to sell, to need to sell, to can’t live without selling. They become motivated sellers who are more willing to negotiate down and/or they become agreeable to financing a portion of the sale price.

1. What’s another strategy I can use to buy more home for less money?

a. Buy during the holidays. Most people are busy shopping and traveling. This reduces competition even more. Depending on their tax situation, some sellers may want to sell before the new year to reduce their tax burden.

2. I don’t have enough money to buy my dream home, is there anything I can do?

a. The thought of debt terrifies some, however, astute home buyers realize that debt is the tool to make a lot of money. So, borrow money from family and friends. You still must pay off their loan, but savvy home buyers know that real estate appreciates historically and therefore after a few years they’ll be able to refinance to access their home’s equity and thus pay off their friends and family loan.

3. Which strategy does GVH think is the most effective?

a. Applying all these strategies together gives you the best chance of success. To answer directly though, it’s financing the hell out of your home.

Is it time to cash in on your home’s equity? Would you like help figuring out how to buy more home for less money? The easiest path may be to see what a real estate investor would pay for your current home. With Good Vibes Homebuyers, you get more solutions than just an all-cash offer and several pay you more than market value. Contact us today!

Free closing costs. Free Local Move. Zero fees. Sell in 5 days. Sell and stay for 180 days. No equity? Still get $10,000 cash!

Picking the wrong investor can leave you scrambling & empty-handed. Learn how to spot the bad from good investors & see the top reasons to pick Good Vibes Homebuyers.

What sounds better - winning or losing? Home investors don't want you to know these 4 magic negotiation tactics because you'll kick their butt and come out a winner!

Good Vibes Homebuyers might be the perfect option for many Texas property owners needing to sell a house. Ask yourself these questions to see if our investors are right for you.